Our senior team has decades of extensive advisory experience working on various types of transactions across the world. We have advised clients in a variety of M&A situations including mergers of equals, take-privates, corporate carve-outs, leveraged buyouts, and joint ventures among others. In addition, our team has helped clients raise equity and debt capital for various uses. Our services include:

Sales and Divestitures

Buy-side Advisory

Board Advisory

Special Situations

Strategic Capital

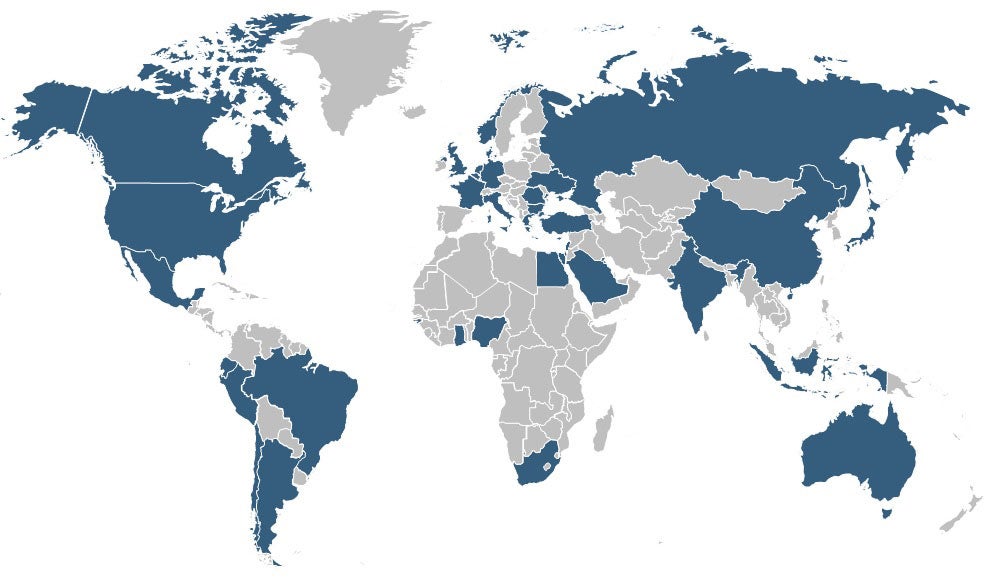

Our team is based in the United States and Switzerland and has worked with clients across the world. Our cross border transaction experience includes projects throughout the Americas, Western and Eastern Europe, Russia/CIS, Africa, the Middle East/Israel, and Asia. Most of our transactions have cross-border elements.

The principals of Three Keys have worked with all types of clients.

We understand the unique dynamics for each different type of client, including regional dynamics, and tailor our engagements and advice to best suit each client’s strategic and financial objectives.